Living and working as an adult work professional in Munich comes with unique financial challenges. Unlike traditional jobs, there’s no employer withholding taxes, no automatic pension contributions, and no safety net. If you’re doing this work independently-whether full-time or part-time-you need to take control of your money before it slips through your fingers. This isn’t about being rich. It’s about staying stable, avoiding surprises, and building real security in a job that doesn’t offer any by default.

Understanding Your Tax Obligations in Munich

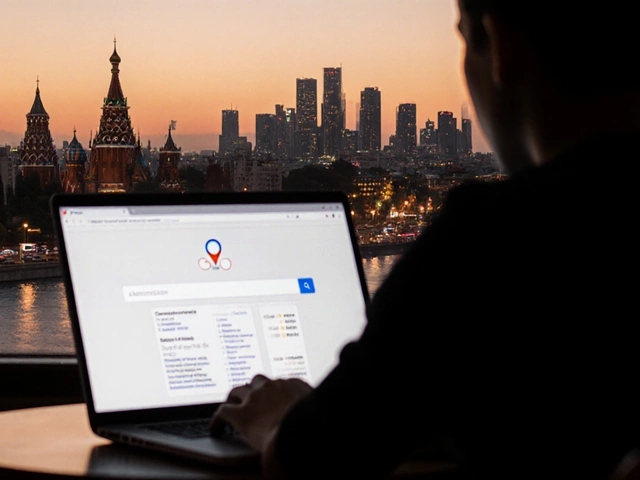

If you’re earning money from adult work in Munich, you’re considered self-employed. That means you must register as a Freiberufler or Kleinunternehmer with the local tax office (Finanzamt). Many people assume they can stay under the radar, but Germany has strict reporting rules. The Finanzamt cross-checks bank statements, payment apps like PayPal or Revolut, and even rental contracts. If you’re earning more than €22,000 a year, you’re required to charge VAT (19%) and file quarterly returns.

Here’s what you actually owe:

- Income tax: Ranges from 14% to 45%, depending on your total earnings

- Solidarity surcharge: 5.5% of your income tax (phased out for most under €65,000)

- Church tax: 8-9% of income tax if you’re registered with a recognized church

- VAT: 19% if your annual turnover exceeds €22,000

Most professionals in Munich earn between €30,000 and €70,000 annually. At €50,000, you’ll pay roughly €12,000-14,000 in taxes after deductions. That’s not optional. If you skip filing, penalties start at €250 per month and can snowball into fines over €10,000. Registering early isn’t just smart-it’s your only protection.

How to Track Income and Expenses Like a Pro

You can’t guess your expenses. You need receipts. Every euro you spend on work-related items can be deducted. That includes:

- Photography and editing services

- Website hosting and domain fees

- Transportation to appointments (mileage or public transit tickets)

- Professional clothing and accessories

- Software subscriptions (like scheduling tools or payment processors)

- Health insurance premiums (if you’re not covered by public insurance)

- Accounting or legal advice

Use a simple spreadsheet or free apps like Lexware or SevDesk to log every transaction. Don’t wait until tax season. Set aside 10 minutes every Sunday to update your records. One professional I spoke with in Munich lost €3,200 in deductions last year because she didn’t keep receipts from her last two clients. That’s nearly a full month’s rent gone.

Building Savings When Your Income Is Unpredictable

Some months you’ll earn €8,000. Others, you’ll scrape by on €1,500. That’s normal. But without savings, one slow month can mean eviction or debt. The goal isn’t to save 10%-it’s to build a buffer that covers 3-6 months of living costs.

Here’s how to do it:

- Open a separate savings account at a German bank like N26, ING, or Deutsche Bank. Don’t mix it with your spending account.

- Every time you get paid, move 30% straight into savings. Even if it’s €200, do it.

- Set up automatic transfers so you don’t have to think about it.

- Only touch this money for emergencies: medical bills, car repairs, or sudden loss of income.

One escort in Schwabing built a €15,000 emergency fund over 18 months by saving just €800 a month. She didn’t cut back on everything-she just stopped spending on impulse buys and subscriptions she didn’t use. That fund got her through a six-week injury when she couldn’t work. No loans. No panic.

Health Insurance: What You Can’t Afford to Skip

Germany requires everyone to have health insurance. If you’re self-employed, you can choose between public (gesetzliche Krankenversicherung) and private (private Krankenversicherung). Most adult work professionals pick private because public insurance doesn’t cover all the services you might need-and it can be harder to get approved if you’re in a high-risk profession.

Private insurance starts around €200-350/month, depending on age and coverage. Look for plans that include:

- Regular STI screenings

- Mental health therapy

- Emergency dental care

- Travel coverage (if you work outside Munich)

Don’t go uninsured. A single hospital visit without insurance can cost €5,000. One woman I know in Munich delayed treatment for a pelvic infection because she was afraid of the bill. By the time she went to the doctor, she needed surgery. The cost: €12,000. Her insurance would’ve covered 90%.

Retirement Planning: It’s Not Too Late to Start

You might think retirement is years away. But if you don’t start now, you’ll be working until you’re 70. The German state pension (gesetzliche Rente) won’t cover much if you’ve only paid in sporadically.

Here’s your best option: the Riester-Rente. It’s a government-subsidized private pension plan. For every €100 you contribute, the state adds €175. You get up to €1,750 per year in subsidies if you have children. Even if you don’t, you still get €150-200 annually just for signing up.

Set up a Riester plan with providers like Deutsche Bank, Allianz, or DKB. Contribute €50-100 a month. That’s less than a daily coffee. After 10 years, you’ll have over €10,000 from your own contributions plus €2,000+ in state bonuses. That’s not a fortune-but it’s a foundation.

What Not to Do

Here are the three biggest mistakes I’ve seen professionals make:

- Using cash only-It’s harder to prove income, and you can’t build credit or get loans.

- Co-mingling personal and business money-It makes taxes a nightmare and hides your real financial picture.

- Waiting until the last minute-Tax deadlines in Germany are strict. Missing them costs you more than the tax itself.

Also, avoid “financial gurus” who promise quick wealth or secret tax loopholes. Germany’s system is transparent. The only secret is consistency.

Where to Get Help

You don’t have to do this alone. Munich has several organizations that support sex workers financially:

- Prostitution Information Center (PIC)-Offers free tax consultations and help with registration

- Arbeiterwohlfahrt (AWO)-Provides low-cost financial coaching

- Sex Workers’ Project Munich-Runs monthly workshops on budgeting and legal rights

These services are confidential. No one will report you. They’ve helped over 400 professionals in the last two years file taxes correctly and avoid fines.

Final Thought: Your Money Is Your Power

Financial control isn’t about being perfect. It’s about being prepared. When you know exactly how much you have, where it’s going, and what you’re saving for, you stop feeling like a victim of circumstance. You become the person who decides what happens next.

One woman I met in Munich started saving €200 a month while working three nights a week. Two years later, she bought a small apartment in the suburbs. She still works, but now she chooses when. That’s not luck. That’s planning.

Do I have to register as a business if I earn under €22,000 per year?

Yes. Even if you earn under €22,000, you still need to register as a self-employed person with the Finanzamt. You may qualify as a Kleinunternehmer and be exempt from VAT, but you must still declare your income and pay income tax. Not registering is illegal and risks fines.

Can I use PayPal or Revolut for my income?

Yes, but you must report all income from these platforms to the Finanzamt. They can request transaction records from PayPal and Revolut. Using these services is fine as long as you keep records and declare everything. Don’t assume anonymity-Germany’s tax authorities have access to international payment data.

Is it possible to get a mortgage as an adult work professional in Germany?

Yes, but it’s harder. Banks require two years of tax returns and proof of stable income. If you’ve registered properly and have consistent earnings, some banks like DKB or ING will approve you. You’ll need a larger down payment (20-30%) and might pay slightly higher interest rates. Transparency is key-hiding your profession will get your application rejected.

What happens if I don’t pay my taxes?

You’ll face penalties of €250 per month for late filing, plus interest on unpaid taxes (up to 6% annually). If the Finanzamt finds undeclared income, you’ll be charged back taxes for up to 10 years. In severe cases, they can freeze your bank accounts or seize assets. It’s not a risk worth taking.

Can I claim my rent as a business expense?

Only if you have a dedicated home office used exclusively for your work. You can deduct a portion of your rent based on square footage. For example, if your home office is 10% of your apartment, you can claim 10% of rent, utilities, and internet. Keep floor plans and photos as proof. General living expenses like rent or groceries are not deductible.

If you’re just starting out, begin with one step: register with your local Finanzamt. Then set up a separate savings account. That’s it. Everything else builds from there. You don’t need to fix everything at once. Just start. The future you will thank you.