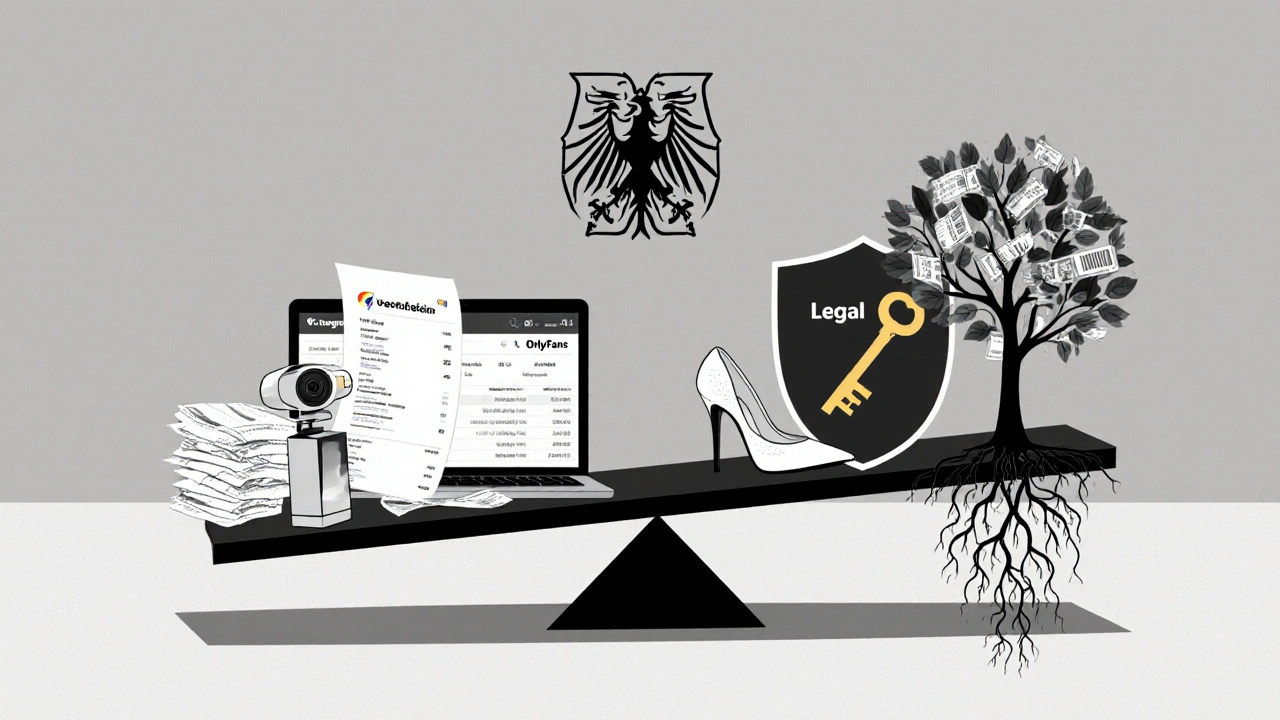

If you're doing adult work in Munich - whether as an independent escort, webcam model, or private provider - you’re running a business. Not a hobby. Not a side gig. A real, taxable business. And that means dealing with taxes, bank accounts, and money management like any other entrepreneur. Most people assume the gray nature of this work makes it impossible to handle finances legally. That’s not true. It’s just different. And if you skip the basics, you risk fines, account freezes, or worse.

Understanding Your Legal Status in Munich

In Germany, sex work has been legal since 2002 under the Prostitution Act (ProstG). That means you can register as a self-employed person, open a business bank account, and pay taxes like any other freelancer. You’re not breaking the law by doing this. You’re exercising your rights. But being legal doesn’t mean it’s easy. The system wasn’t built for people in adult work, so you have to navigate it carefully.

You must register with the local trade office (Gewerbeamt) as a Gewerbetreibende. This gives you a tax ID and puts you on the radar - which is exactly what you want. Avoiding registration doesn’t make you safer. It makes you vulnerable. Unregistered income is invisible to the system, which means you can’t prove earnings, can’t get loans, and can’t build credit. Worse, if the tax office finds out later, penalties can be 10-20% of undeclared income, plus back taxes and interest.

Opening a Business Bank Account

Banks in Germany are cautious about adult work. Many will refuse to open an account if you say you’re an escort. But that doesn’t mean it’s impossible. You don’t need to say “escort.” You say “independent service provider” or “freelance consultant.” The law doesn’t require you to disclose your specific industry - only that you’re self-employed.

Some banks are more open than others. Sparkasse branches in Munich, especially outside the city center, are often more flexible than big corporate banks like Deutsche Bank or Commerzbank. Revolut and N26 are also options, but they’re not ideal long-term. They can close accounts without warning if transactions trigger fraud filters - and payments from adult work platforms often do.

Here’s what you need to open an account:

- Valid ID or passport

- Residence registration (Anmeldung)

- Trade license (Gewerbeschein)

- Proof of address (utility bill or rental contract)

Bring all documents. Be calm. Don’t apologize for your work. Say: “I’m a self-employed service provider. I need a business account for invoicing and tax purposes.” If they hesitate, ask to speak to a manager. Many bank staff don’t know the law and default to refusal. A manager who’s seen this before will know it’s legal.

Taxes: What You Owe and How to Pay

As a self-employed person in Munich, you pay three main taxes:

- Income tax - based on your net profit. Rates range from 14% to 45%, depending on how much you earn.

- Solidarity surcharge - 5.5% of your income tax. This applies if you earn over €17,500/year.

- Trade tax (Gewerbesteuer) - a local tax set by the city. In Munich, it’s about 14% of your trade income after deductions.

You also pay VAT (Umsatzsteuer) if your annual revenue exceeds €22,000. Most independent escorts stay under this limit, so they’re exempt. But if you’re earning more - say, from a website or agency - you must register for VAT and charge 19% on services.

You file taxes annually using the Einkommensteuererklärung. You can do it yourself using free software like Elster, or hire a tax advisor who’s experienced with sex workers. Look for one who says they’ve worked with “freelancers in personal services.” Avoid anyone who acts uncomfortable - you need someone who’s seen this before.

Keep every receipt. Even small ones. Gas for appointments, phone bills, cleaning supplies, website hosting, even a new pair of heels if you use them for work - all are deductible. The German tax office accepts these as business expenses. You don’t need to prove how you used them, just that you bought them.

Managing Cash Flow and Savings

Adult work income is often irregular. One month you earn €4,000. The next, €800. That’s normal. But it’s dangerous if you don’t plan for it.

Set up a separate savings account - not linked to your business account. Every time you get paid, transfer 30% straight into it. This is your tax and emergency fund. When tax season comes, you’ll have the money ready. If you get sick or an appointment falls through, you’re not scrambling.

Use apps like Finanzguru or Wally to track income and expenses. They sync with your bank account and categorize spending automatically. You’ll know exactly where your money goes - and you’ll have proof ready if the tax office asks.

Don’t mix personal and business money. Even if you’re the only one using the account, keeping them separate makes everything cleaner. It’s not just about legality - it’s about sanity.

Dealing with Payment Platforms

Many adult workers use platforms like OnlyFans, ManyVids, or Patreon. These are convenient, but they’re also risky. They report earnings to tax authorities. In Germany, platforms like these are required to share data with the tax office. So if you’re earning €500/month on OnlyFans, the Finanzamt already knows.

Don’t try to hide it. Declare it. Add it to your income. If you don’t, you’re leaving yourself open to audits. And if they find discrepancies, you’ll pay penalties plus interest - sometimes more than you saved by hiding it.

Some platforms allow you to invoice them as a business. That’s better than receiving direct payments. It gives you control over how the money is labeled. You can send invoices with your business name, tax ID, and service description like “digital content creation” or “online consulting.” That sounds professional. And it avoids red flags.

What Not to Do

Here are the biggest mistakes people make:

- Using personal bank accounts - This triggers fraud alerts. Banks freeze accounts when they see frequent cash deposits from unknown sources.

- Not keeping receipts - You can’t deduct what you can’t prove. Save every digital receipt. Use Google Drive or Dropbox to back them up.

- Ignoring the trade license - No Gewerbeschein? You’re not legally operating. That puts you at risk if anything goes wrong - including disputes with clients.

- Asking for advice from other escorts online - Everyone’s situation is different. What worked for someone in Berlin might not work in Munich. Always verify with a professional.

Where to Get Help

You don’t have to figure this out alone. There are organizations in Germany that specialize in helping sex workers with legal and financial issues.

PROSIT (Prostitution Support and Information Team) in Munich offers free legal advice, tax workshops, and even help filling out forms. They’ve helped hundreds of people open bank accounts and file taxes without shame or fear.

Deutsche Gesellschaft für Sexualwissenschaft also runs monthly financial clinics in Munich for independent workers. You can walk in without an appointment. No judgment. Just clear, practical help.

These services exist because the system should work for everyone - not just the ones who fit the mold.

Final Thoughts

Doing adult work in Munich doesn’t mean you have to live in the shadows. You can be legal, organized, and secure. It takes effort - yes. But the freedom that comes from knowing you’re doing everything right? That’s worth it.

Start small. Register your trade. Open a business account. Set aside 30% of every payment. Keep your receipts. File your taxes. You don’t need to be perfect. You just need to be consistent.

The system doesn’t care what you do for a living. It only cares if you follow the rules. And if you do? You’re not just surviving. You’re building something real.

Can I open a bank account in Munich if I’m an escort?

Yes. You don’t have to say you’re an escort. You register as a self-employed service provider. Bring your trade license, ID, and Anmeldung. Sparkasse and smaller local banks are more likely to approve you than big corporate banks. Revolut and N26 are options but carry higher risk of sudden account closures.

Do I have to pay taxes on income from OnlyFans or Patreon?

Yes. Platforms like OnlyFans report earnings to the German tax office. You must declare this income in your annual tax return. You can deduct business expenses like website fees, equipment, and travel. If your annual income is under €22,000, you’re exempt from VAT. Keep records of all payments and expenses.

What happens if I don’t register my adult work as a business?

You’re operating illegally. If the tax office finds unreported income, you’ll owe back taxes, interest, and penalties of up to 20%. You won’t be able to get loans, rent apartments, or prove income for visas. Registering protects you - it doesn’t put you at risk.

Can I deduct expenses like clothing or makeup?

Yes. If you use clothing, makeup, or hair styling specifically for work, you can deduct them as business expenses. You don’t need to prove exact usage, but you must keep receipts. A new outfit worn for a client appointment counts. Regular everyday items don’t.

Where can I get free tax help in Munich?

PROSIT Munich offers free legal and tax advice for sex workers. They hold monthly workshops and help with form filling. The Deutsche Gesellschaft für Sexualwissenschaft also runs financial clinics. Both are confidential and non-judgmental. You don’t need an appointment.